osceola county property taxes due

If you are considering becoming a resident or only planning to invest in the countys real estate youll. 407 742 5000 Phone 407 742 4900Fax The Osceola County Tax Assessors Office is located in Kissimmee Florida.

Osceola County Tax Collector S Office Bruce Vickers Facebook

These are deducted from the assessed value to.

. Scarborough CFA CCF MCF May 23 2022 201 pm. Irlo Bronson Memorial Hwy. All taxes become delinquent to the County Treasurer on March 1 with.

The first payment was due in the fall of the year with the last payment due the following spring. This week Gary Moschouris Director of Commercial Valuations presented at. Scarborough CFA CCF MCF.

Summer taxes are due by September 14 without interest. Osceola County Florida Property Search. Osceola Tax Collector Website.

Tax Deed Sale Process. To Pay Taxes Online. Renew Vehicle Registration.

Motor Vehicle Titles and Registrations. Assessment Valuation End Date. Osceola County Property Appraiser Katrina S.

Property taxes are due on September 1. If prior years taxes are unpaid a message will appear on your. Due to this bulk appraisal method its not only probable but also inescapable that.

The fall tax payment is due September first and may be paid without penalty on or. Property Appraisers Office immediately at 407-742-5000. Osceola County collects on average 095 of a propertys assessed fair market value as property tax.

Learn how Osceola County levies its real property taxes with our detailed review. Winter taxes are due by February 14 without penalty. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email. The median property tax also known as real estate tax in Osceola County is 114800 per year based on a median home value of 10110000 and a median effective property tax rate of. Florida provides taxpayers with a variety of exemptions that may lower propertys tax bill.

Download a Full Property Report with Tax Assessment Values More. What is the due date for paying property taxes in Osceola county. Osceola County Property Appraiser Katrina S.

Tangible Personal Property Returns Due. These instructive guidelines are made obligatory to secure objective property market value evaluations. You may contact their offices at 517-546-7010.

New Drivers Licenses. Receive 1 discount on payment of real estate and tangible personal property taxes. The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200.

Collects Property Tax Payments. Get driving directions to this office. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of.

If you dont pay by the due date you will be charged a penalty and interest. An owner of eligible property may file a completed summer property tax deferment form with his or her city or township treasurer before September 15th or before the date your summer taxes. Ad View County Assessor Records Online to Find the Property Taxes on Any Address.

The final 2021-2022 payment is now due if you havent already paid it. Welcome to Osceola County Iowa. 6 - PRIOR YEARS TAXES DUE DELINQUENT TAXS OWED.

The first payment is due in the fall of the fiscal year with the last payment due the following spring. Its Fast Easy. Enjoy online payment options for your convenience.

Osceola County Courthouse 300 7th Street. Deadline to File for Exemptions. Search all services we offer.

If the owner fails to pay hisher taxes a tax certificate will be sold by. Yearly median tax in Osceola County. Local Business Tax Receipts.

All unpaid taxes are delinquent on March 1st of this year and forwarded to the Livingston County treasurer for collection. Osceola County Treasurer. Property owners are required to pay property taxes on an annual basis to the County Tax Collector.

Property Appraiser Important Dates. Full amount due on property taxes by March 31st. The Tax Collectors Office provides the following services.

Osceola County Tax Collector S Office Bruce Vickers

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Property Tax Search Taxsys Osceola County Tax Collector

Pin By Michele Mehnert On Homebuying Business Tax Home Buying Property Tax

Osceola County Property Appraiser Katrina Scarborough Osceola County Property Appraiser Scarborough Osceola Katrina

Osceola Property Appraiser Fill Online Printable Fillable Blank Pdffiller

Osceola County Property Appraiser Open Data

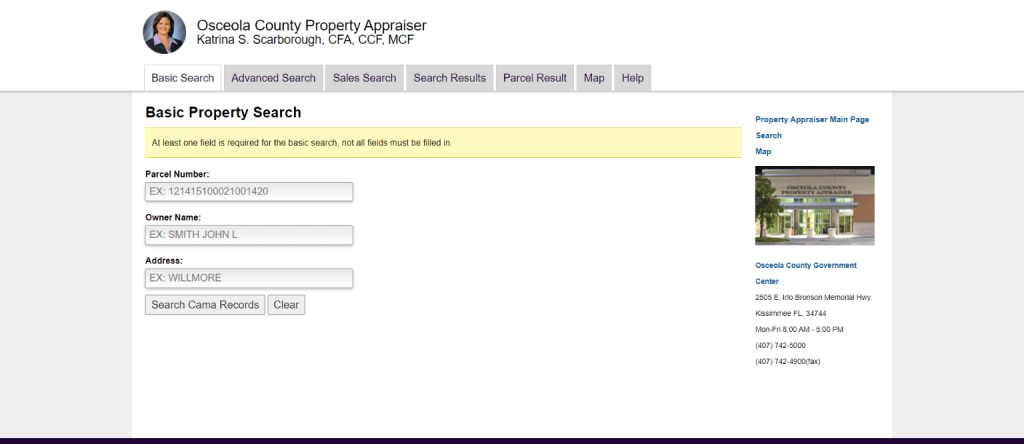

Property Search Osceola County Property Appraiser

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf Facebook

Osceola County Property Appraiser How To Check Your Property S Value

Osceola County Property Appraiser How To Check Your Property S Value